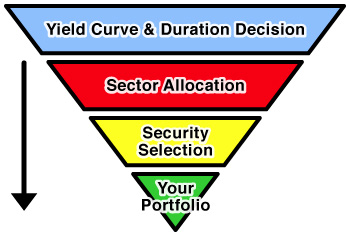

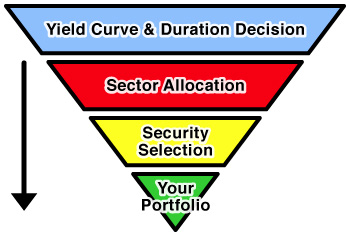

Vanderbilt's Bond Management is a systematic, disciplined approach that focuses on three critical decisions: Yield Curve and Duration, Sector Allocation, and Security Selection.

| Fixed Income Process |

|

Yield Curve and Duration

Vanderbilt Avenue Asset Management has identified five key variables that are significant determinants of fixed income performance: monetary policy, level of economic activity, shape of the yield curve, inflation and real rates. Appropriate data is thoroughly analyzed using both sophisticated modeling techniques and the accumulated experience of our investment professionals. Based on the overall reading of these variables, we adjust duration within a 20% range around the benchmark and frequently well within this range.

| Duration Analysis Example |

| Monetary Policy |

Positive |

1 |

| Economic Activity |

Neutral |

0 |

| Yield Curve |

Positive |

1 |

| Inflation |

Positive |

1 |

| Real Rates |

Neutral |

0 |

Using Vanderbilt's distinct methodology, the yield curve is then analyzed to determine the optimal positioning of our duration decision. At each point in time, we compare a "fairly valued" yield curve to actual market activity. Our model generates a theoretical price which is compared against an observed market price to determine areas of the curve that are rich, cheap or fairly valued.

| Treasury Model Example |

|

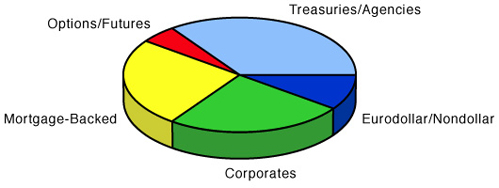

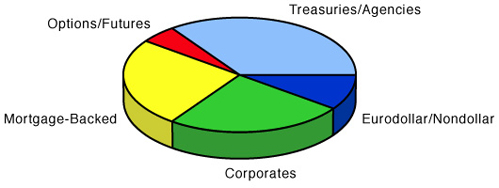

Sector Allocation

At Vanderbilt Avenue Asset Management, our investment professionals also research the risk-reward relationships among the various sectors of the debt market. We maintain a core portfolio of the highest quality securities (Treasuries and Agencies) until another sector of the bond market offers value. A proprietary statistical test has been developed to ascertain values across sectors. Care is taken to compare spreads only at comparable points on the business cycle. In addition, volatility is monitored in order to properly price the embedded options in non-Treasury securities. Our research indicates that volatility is mean reverting. In general, if volatility is high and is expected to revert back to its mean level, investment grade corporates and mortgages are preferred to Treasuries and agencies. On the other hand, if volatility is low and is expected to trend higher, we will overweight puttable and non-callable issues.

| Sector Allocation Example |

|

Security Selection

Issue selection in the corporate sector is made on the basis of superior credit profiles versus a peer group and upward credit momentum as evidenced by significant positive earnings announcements. Credit quality is gauged by three measures which emphasize cash flow and liquidity. These measures are (1) interest coverage by earnings before interest, taxes and depreciation (EBDIT coverage), (2) interest coverage by earnings before interest, taxes and depreciation less capital expenditures (EBDIT - CapX coverage), and (3) debt maturing in the next three years to total debt. In addition, issuers are selected which have displayed a pattern of earnings above consensus expectations. The unexpected earnings component captures the quasi-equity properties that corporate bonds tend to exhibit. Research indicates that such positive as well as negative announcements, relative to consensus expectations, tends to exhibit recurring patterns. In this fashion, Vanderbilt is able to construct corporate portfolios which exhibit solid, and improving credit fundamentals. Once purchased, issuers are continually monitored for any deterioration in credit measures or earnings significantly below consensus expectations. Such deterioration or negative earnings announcements would signal a sell candidate from the portfolio.

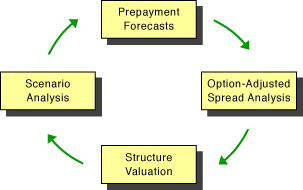

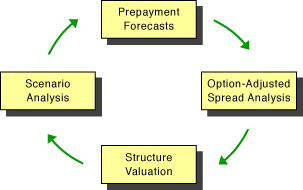

Issue selection in the mortgage sector utilizes horizon analysis. The mortgage team at Vanderbilt Avenue Asset Management combines prepayment characteristics with yield curve effects and volatility expectations in order to study return/risk scenarios. Mortgage structures and individual securities that provide the maximum return and the minimum risk are then selected from these scenarios for inclusion in portfolios. On a continuous basis, option adjusted yields are evaluated for the following classes:

|

- GNMAs vs. conventionals

- Premiums vs. discounts

- PACs vs. collateral

|

We utilize option-adjusted spread analysis to deal with the drawbacks of traditional analysis. Our approach at Vanderbilt differs from traditional fundamental analysis in two ways. First, our analysis introduces interest rate volatility. Instead of assuming that interest rates remain at their current levels over the life of a security, Vanderbilt evaluates securities under the more realistic assumption that interest rates are likely to vary in an unpredictable fashion. Second, instead of using a single discount rate, we discount MBS cash flows by the full interest rate path. Also, our mortgage specialists conduct breakeven analysis (i.e., by how much MBS spreads have to widen before underperforming Treasuries) on every security to be included in our portfolio. |