|

||||||||

|

||

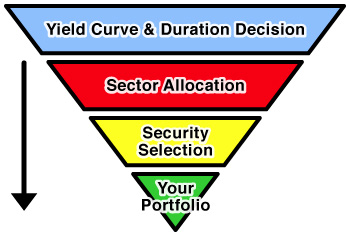

The primary objective of Vanderbilt Avenue Asset Management's investment process is to provide above average returns, which over time lead to cumulative superior returns. Our research has indicated that yield is the primary source of return on a long term basis and that returns vary significantly among different sectors and individual issues. Therefore, we concentrate on identifying the best combination of yield and relative value within our duration parameters. We employ a systematic, disciplined approach that encompasses three key elements:

We have determined that a limited duration is sufficient to provide both principal protection and competitive returns. Once the duration decision has been established we determine the optimal positioning of assets along the yield curve. A regression model has been developed to highlight areas on the curve that are rich, cheap and fairly valued. In addition, other quantitative methods are employed to support the results of our model. Our selection of sectors and securities is based on our ability to quantify value within a universe of bonds with very different characteristics. For sector selection, this quantification of relative value is identified by the analysis of two factors: yield spreads and volatility expectations. We select individual securities that reflect our sector decisions. Our credit analysis emphasizes cash flow, balance sheet structure and deviations in analysts' estimates from the mean.

|

|